.jpg)

Kids First

Financial Literacy for Ages 5-10

These are prime years for teaching the basics of money management. Your kids are gaining a more in-depth understanding of how money works and are still interested in learning from their parents. During this age range, your kids should be ready for a number of mature financial steps.

Key Money Basics Ages 5-10

- The importance of budgeting

- Opening a bank account

- Earning an allowance and the responsibilities of saving and spending money

- How small businesses work

- Saving up for a major purchase and longer-term goals

- Performing small jobs to learn the value of earning money

- Kids ages 8-10 should also be learning about the basics of online banking. Using money- and number-based online games, apps, and educational resources to expand digital financial learning.

- Preparing for peer pressure. Around age 8 is when peer pressure begins to influence some children.

.jpg)

START SAVING

Kids First Savings is a special type of savings account and rewards program offered through First National Bank exclusively for children ages 16 or younger. Everyone wants the best for their kids, and part of equipping them for life is helping them set up a savings account. Stop by any of our locations to help your child open their Kids First savings account.

A savings account:

- Introduces the savings habit early. Saving is central to financial security. Urge them to save part of their allowance or birthday money.

- Incentivizes them to save more. With the Kids First savings account, each child receives a savings card that gets stamped for every $10 deposit. Once the card is completed, the child receives a prize (e.g., coupon to a local business, coin bag, piggy bank, or other special prize).

- Helps with a big purchase. Kids can use their savings to make a larger purchase than their regular allowance.

- Is a stepping stone. Eventually, kids will need a checking account, debit card, credit card, loan, and college savings. A savings account is the first step toward all the other financial tools they will need in the future.

Learn More About the Special Features of a Kids First Savings Account

Hands-on Activities

HAVE HONEST CONVERSATIONS ABOUT MONEY

Don't scare or worry kids about money at this age, but there are life lessons to be learned about budgeting and limits on spending. Teach them not to follow every whim, and that it's ok to say no to spending money you don't have. Tell them it's not in the budget.

RESEARCH PURCHASES

Whether it is buying groceries or taking a family vacation, involve your kids in the research so that they can understand how to find deals and how to tell if they're paying a reasonable price.

TALK ABOUT ADVERTISING

Talk about branding and how it can influence spending decisions, including the pressure to buy something you don't really need. Focus on fostering self-esteem, based on your kid's special talents and personal qualities, not what they wear, buy or use.

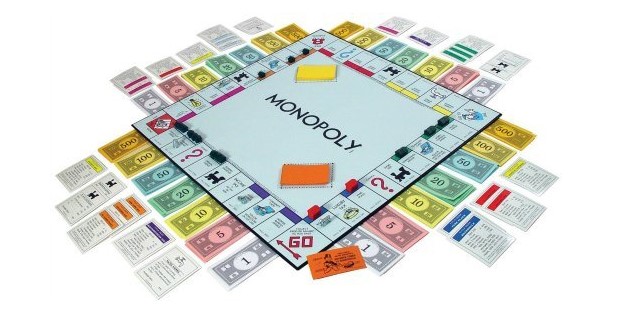

TEACH THROUGH MORE ADVANCED PLAY

Play card and board games together. Age appropriate games about money include:

Play card and board games together. Age appropriate games about money include:

- Money Match Me (card game, ages 6-8)

- Money Bags Game (board game, ages 7+)

- Moneywise Kids (bill handling game, ages 7-12)

- Buy It Right (board game, ages 5-12)

- Game of Life (board game, ages 8 and up)

- Pay Day (board game, ages 8 and up)

- Monopoly (board and bill handling game, ages 8 and up)

In addition to these traditional games, consider allowing your kids access to supervised, age-appropriate online games that focus on money and money management.

Have your child count and roll coins from their saving jar or piggy bank into paper bank wrappers. Challenge your kids to calculate change using coins and dollar bills.

Printable Worksheets