Money Management

Section Menu

Ready to take control of your finances? Money Management can help.

To be successful at anything, you need the right information and a good plan. That goes with your finances as well. With First National Banks’s Money Management™ tool (part of our online and mobile banking services), you can see how much money you have, where you’re spending it, and how close you are to reaching your financial dreams.

With everything right there in front of you, it’s much easier to develop a plan to reach your goals.

The best part, Money Management is free and available for all online and mobile banking clients.

Contact us if you have any questions about Money Management or follow the instructions below to get started this fantastic financial tool.

Contact Us

Money Management's Features

.png)

|

Set your financial goals.

Goals can help users plan ahead and visualize long-term financial objectives, such as saving for a home or vacation. This tool provides a timeline of prioritized goals, and projects how long it will take to complete each goal based on a user’s savings plans. There are three types of goals that can be created: Savings, Debt Payoff, and Retirement.

|

|

Create your own budget.

Set your household Budget; create custom budget categories; change monthly allocations; and determine the status of your budget goals.

|

|

Track spending.

The Spending view displays your spending across all categories for the time period selected. This can provide you with powerful insights on where, when, and how you spend.

|

|

Analyze trends.

The Trends tab is helpful for viewing spending trends over time. It displays up to 12 months of spending by category.

|

|

Access all of your accounts in one place.

See all of your accounts, including those with other financial institutions. Aggregate the following types of accounts: checking, savings, investment, loans, credit cards, and more.

|

|

Understand and payoff your debt.

The Debts tab is a powerful tool that allows you to see all of your debts in one place, create an expedited payoff plan, and calculate the time and money to be saved by using the snowball method.

|

|

Determine your net worth.

Net Worth tracks the net sum of all your assets and liabilities over the past year.

|

|

Manage your cash flow.

Cash Flow helps individuals understand not just their historical spending, but also predicts their future spending. It allows users to easily identify and add recurring bills and payments. In addition, Cash Flow lets users add one-time or annual payments that may be considerable and require future planning, such as property tax.

|

How to Get Started

To use the Money Management tool, you must be a customer of First National Bank who uses online or mobile banking. If you're not already enrolled, we can help you register now. There is no cost to register or use these services.

In addition to being able to use Money Management, you’ll be able to stay connected to your account activity, make transfers, bank from nearly anywhere, and even deposit checks with your smartphone.

Register Now

To use to use Money Management on your mobile device, you will also need to download First National Bank’s mobile app. Our mobile app is available for download from Apple Store or Google Play.

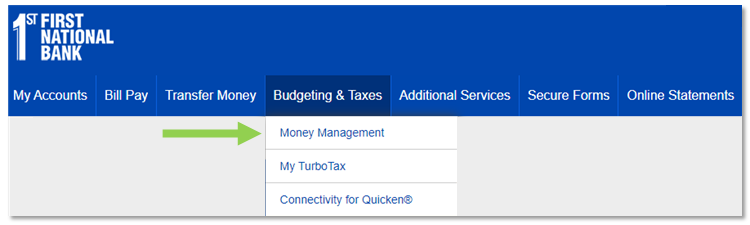

ONLINE BANKING. Login to your First National Bank online banking account. In the "Budgeting & Taxes" tab, click on "Money Management".

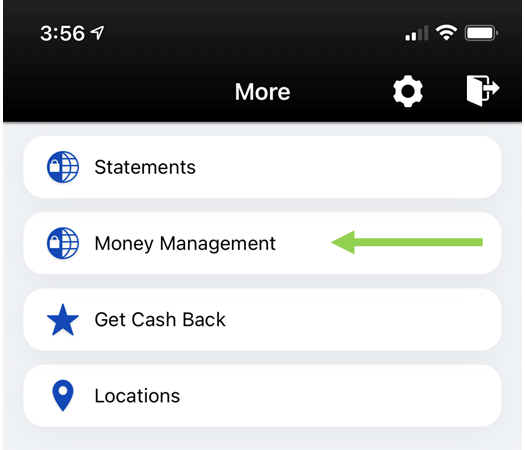

MOBILE APP. Login to First National Bank's mobile app. Go to the "More" menu, which is located at the bottom of your screen. Then click on "Money Management."

Watch the Demo to See How Money Management Works